In 2010 after a gig that didn’t go well because they club owner couldn’t pay the bands, I opened up my bank app on my phone to check my bank balance and realized it was almost zero and only $10 bucks in savings.

I huge migraine began to emerge. What was I gonna do?

This was an event that really changed my thinking, I had to really learn about finance. I picked up a book, by Dave Ramsey called “Total Money Makeover”. This book transformed my financial life, and I now had a grasp on how to control my finances.

In combination with reading many other books there was another title by MJ DeMarco called “The Millionaire Fastlane”. Don’t let the title fool you, it’s probably one of the best business books in the market.

Multi-Millionaire entrepreneur Brain Tracy states:

“If you read 30-60 minutes daily in your chosen profession. In just a few years you will be an expert at your field.”

The issue is most people don’t read. Wanna know how to keep a secret??

Write it in a book.

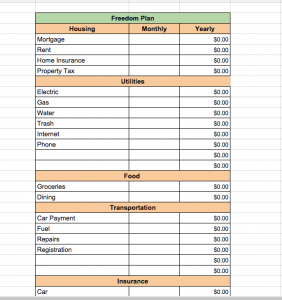

Okay enough jokes, let’s get to the Financial Freedom Plan for Musicians. Below is a spreadsheet that you need to use to calculate your future. Available for Excel, Apple Numbers, and Google Sheets. To use it you must pay for the software, but Google Sheets is FREE. All you need is to sign up on google for Gmail account. Click on the link and download your spreadsheet..

Financial Freedom Plan for Musicians xlsx

This is simple, It doesn’t require quantum physics, just basic math for all you geniuses. Just follow the directions below to fill out the plan above.

- The spreadsheet has a sample plan for you, but you can adjust it based on your current situation.

- In the first section called “Current Situation”.

- Enter in all your expenses in the Second column. The spreadsheet will calculate everything for you.

- You can add any extra personal expenses or debt in column one under the correct section and enter the amount in column two.

- Third column calculates how much you’re spending yearly for that particular expense. As you enter your expenses it should calculate automatically.

- Under “savings” decide how much income percentage you intend to save for all your current savings accounts

- Based on the number you intend to save, let’s say 30% or your income, use this formula (net monthly expenses x 30%) to calculate your Gross Monthly Expense.

- Your Gross Monthly Expenses will tell you the income you need to earn in order to live the lifestyle you need.

- Six Month Emergency Fund: will show how much money you need to save in order to survive if the apocalypse emerges.

- Money System Target: tells you how much you need in order to retire. 5% yearly return of that number will give you your yearly income based off your chosen lifestyle.

- Business System Target: will show you how much your business needs to incur in order to fund business taxes, retirement system target and your monthly income.

- Second section to your right is called “Freedom Plan.” The is the fun part. You will see that in order to live your dream lifestyle it doesn’t require billions of dollars.

- Research how much your mansion, Ferrari, internet, electric, clothes, insurance, and boat is gonna cost you on a monthly basis. This may take you awhile, but it’s fun to research and dream.

- Once you enter in all your monthly expenses the spread sheet will calculate everything.

- Follow steps 6-7 to calculate future savings.

Notice when you finish your freedom plan you realize in order to retire it doesn’t require billions of dollars. I thought I needed close to $100 million in order to live my dream and when I did this plan it turned out to be only $3 million. Not bad!

Cool huh?

Now that you have taken the time to invest and calculate your future, it’s time to take your musical talents and start creating or investing in assets that can create consistent monthly cash-flow.

Ready-set-go!

Thanks again for reading and don’t forget to share this post or leave a comment below.

Peace